Financial Projections

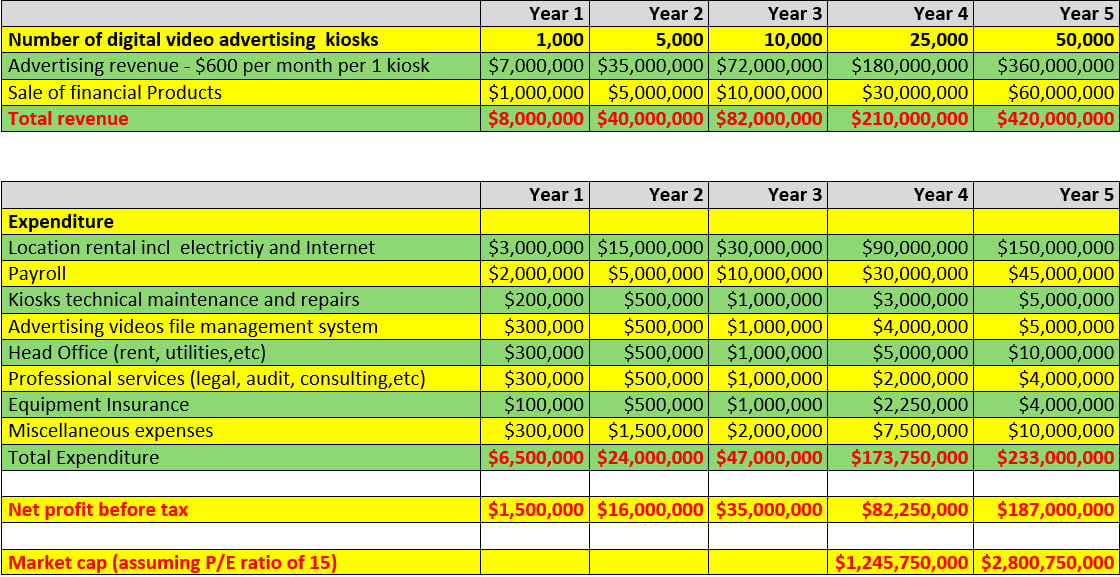

It is projected that the number of kiosks will reach 50,000 within five years - about 15,000 locations (supermarkets, shopping malls, etc), 3-4 kiosks per location, on average.

An assumption is made that each kiosk will yield 600 dollars of advertising revenue per month. Another revenue component will be sale of financial products (See Our Business Model section for details).

The company will not be paying any dividends until the third year of its operation. After that, paying out dividends will be at the discretion of the management and is not guaranteed. Most of the profits will be reinvested into corporate expansion to enhance valuation and market capitalization of the company.

Assuming P/E ratio of 15 to 1, if the company goes public in year 5, its market capitalization might reach almost 3 billion dollars. Under these market conditions, price of 1 share bought initially for $1 can increase to $10-15; an original investment of $10,000 can turn into $100,000-$150,000 within 3 to 5 years.

The ratio of 15 is indicated very conservatively since average P/E ratio is over 30 for NASDAQ-listed stock.

Securities are sold strictly according to the terms and conditions contained in the Private Placement Memorandum. The above projections are assumptions based on preliminary assessment of market potential for digital indoor advertising services. It is not guaranteed, or otherwise represented, that these results will be achieved, since there are multiple risks involved. All the applicable risks are disclosed in the Private Placement Memorandum. These are projections, which are by no means guaranteed, and no such assumptions should be made, since the business is susceptible to multiple risks. No firm promise is made by the Corporation, its founders, majority shareholders, affiliates, control persons, insiders, directors, management, executives, employees, or any other agents that the forecast results will be reached, since these financial projections are conjecture-based, derived in accordance with the Corporate Business plan and hypothetical financial model.